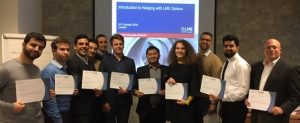

LME Week is always busy, but this year saw record numbers attending the LME introductory training courses.

The courses upgrade knowledge and offer an excellent networking opportunity where topics not on the course agenda can be explored with other market participants. To give a flavour of the spread of attendees, in just one corner we had Nicole, Nikita and Nikola, representing Australia, Estonia and Bulgaria, and working for a packaging company, a physical trader and an LME member.

“Excellent course and would recommend to anybody wanting to get an understanding of the LME”, Environmental Impact Group

“Emma is very professional and her way of explaining helped me understand all the concepts. She was available all the time, she encouraged us to ask questions and to have open discussions”. Lexar Commodities

“The trainer worked 1 on 1 with those students that needed additional help.” Nordmet Invest

The final course of the year will be in New York (10-12 December). 2020 dates are being finalised and will be available for booking shortly. Check out

Upcoming Courses for a full schedule and links to secure your place.