Questions, discussions and quizzes were as lively as the in-person days, helped along by the co-opted in-room assistant collecting answer sheets and calling out results.

Meeting at the Meat Market

Last week’s London Metal Exchange / Euromoney Learning courses took place to the historic Smithfield market. There has been a market on the site for over 800 years, and the current cut meat market dates from about when the LME was founded. Peak activity is between 02:00-06:00 and only stragglers remained as delegates arrived for their training day.

“Best course I’ve been on”

“Use of real examples from participants keeps people engaged”

“It has been invaluable for giving me a better understanding”

Registration links for all courses can be found on the Upcoming Courses page.

Sustainable Learning

Last week’s London Metal Exchange / Euromoney Learning virtual courses saved at least 17 tonnes of carbon emissions compared to a classroom course. Attendees from Singapore to Houston enhanced their knowledge of the LME without needing to catch a flight.

If sustainability is a key metric for your company, or important to you personally, consider joining the next round of virtual LME courses scheduled for 9-13 December. Each course is a series of daily 3-3½ hour sessions which means your learning can be completed without unduly compromising your day-to-day work routine.

“this course ironed out the creases and strengthened my knowledge and explained the LME in a very clear and concise way”

“the pace is well planned and organized”

Registration links for all LME courses can be found on the Upcoming Courses page.

More than you bargain for

Last week’s London Bullion Market Association (“LBMA”) courses on the loco London market and the LBMA’s Responsible Sourcing programme were well received. The sessions are designed to give a thorough grounding in the topics at hand, and offer opportunities for participants to share their individual expertise. We gained bonus insights into recovering precious metals from waste water streams, and digital evolutions in investor products.

“I thought the content was pitched at just the right level …. this really helped me piece all the elements together.”

“It was also great to see a diverse set of professions represented in the course — be it from mining companies, financial services, or banks.”

“it has been an excellent experience”

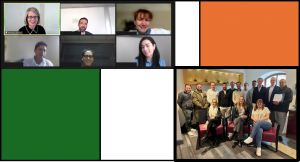

IRL vs IRL

Last week saw all the London Metal Exchange courses running IRL, but in which IRL?

The virtual 3-hour Introduction to LME Cash-Settled Futures was delivered from Dublin, and the In Real Life courses were in London. Attendees from as far apart as Ecuador and Singapore descended on Ireland virtually and London in reality.

“Explained in such simple words that it makes it simple and easy to understand”

“A welcoming environment with continuous opportunity to participate”

Registration links for all LME courses can be found on the Upcoming Courses page.

Feed your brain

This month’s London Metal Exchange / Euromoney Learning courses weren’t just a learning opportunity, as quite a few attendees really enjoyed the food too. Well done etcVenues, the regular venue for in-person London courses, for keeping us well fed over the few days.

“It’s really made me understand the actual business side of my firm’s work.”

“The trainer was extremely credible, knowledgeable and fantastic at explaining the concepts in an engaging way.”

Registration links for all LME courses can be found on the Upcoming Courses page.

Getting back into gear

Plenty of practical examples and workshops banished any lingering post-Christmas slowness and set the attendees up nicely for the coming year.

The next introductory session is scheduled for 4th June. Follow the links to book your place. The follow-on module runs on demand. To express interest in joining a session, please get in touch via training@lbma.org.uk.

What do the punters say?

The final London Metal Exchange / Euromoney Learning course for 2024 took place last week and was delivered in a virtual format over Zoom. It rounded off a tremendous training year which combined a full-on return to classroom training mixed with virtual sessions. Here’s what the attendees thought:

“The trainer was good at keeping the course lively and interesting.”

“I really liked the fact that the trainer was available prior to the course and in breaks to ask any questions.”

“I am convinced that the knowledge I have gained here will be very useful not only for my actual work, but also for sharing my knowledge with my colleagues.”

The 2024 calendar has been launched with the next classroom course scheduled for 6-8 February in London, and the next virtual course for 10-14 June. And new for 2024, the courses will be offered as part of LME Asia Week in Hong Kong, 25-26 June.

Registration links for all LME courses can be found on the Upcoming Courses page.

Spot the odd one out

Last week’s London Bullion Market Association (“LBMA”) virtual training courses on Responsible Sourcing and the loco London market were well attended. The courses offer a great opportunity to gain insights from a broad range of market participants. Lots of lively discussions during the Responsible Sourcing session spilled over into the scheduled breaks and all – instructor included – took away many practical tips.

“The knowledge and insights I gained from the course were invaluable”

“a truly enriching learning experience”

Were they in Australia?

Or was the camera faulty?

The follow-on loco London course – How to use loco London – is already filling up. Make sure you book your box for 24th January 2024. The next Responsible Sourcing and introductory loco London courses will be held at the LBMA office in London on 3rd and 4th June respectively.

You can find registration links for all public courses on Upcoming Courses, or get in touch to arrange a customised session at a time and place that suits your company.

The Virtues of Virtual

The last few weeks have seen all the London Metal Exchange courses running in virtual formats to cater for those who could not make it to London for LME Week. European based physical traders joined with producers across the Atlantic to explore the workings of the LME and how risk can be reduced using LME futures and options. A small group of bankers, wind-farmers and IT providers focussed on the cash-settled futures for steel in a separate afternoon session.

“The course is interesting and provides you with quality information and tools to understand how LME works”

“I feel more confident about LME and about using and applying future contracts”

If you would like to put yourself into one of those boxes, the final London Metal Exchange / Euromoney Learning sessions for the year are running during the week of 4-8 December. A few London afternoon sessions could give you that boost you seek for a successful 2024. And if virtual is not for you, the next classroom courses are scheduled for 6-8 February 2024 in London.

Registration links for all LME courses can be found on the Upcoming Courses page.